State & CCPT Childcare Retirement Benefit FAQ

SPACE Space What is the State & CCPT Child Care Retirement Benefit ? space The State & CCPT Child Care Retirement Benefit is retirement account funding paid by the State of Oregon to all registered and certified family child care providers (RF/CF providers) who have an active license on of 12/11/23.

NEW! What if I need more help to create my account? On November 7th and December 5th in the evening, OregonSaves is providing 2 webinars in English and 2 webinars in Spanish to assist providers to open their account. Visit https://www.oregonsaves.com/ What is OregonSaves? OregonSaves is the State of Oregon’s retirement savings program that provides Oregonians with an easy and automatic way to save for their future. Savers contribute to a portable, low-cost Roth Individual Retirement Account (IRA). Use this link to learn more about Oregon Saves. www.oregonsaves.com Where did the State & CCPT Childcare Retirement Benefit come from? Oregon Child Care Providers Together (CCPT) and the State negotiated a joint retirement committee workgroup (see our contract here). The workgroup was tasked with creating a program to utilize the $5 million dollars allocated in the contract solely for investment in retirement funding for licensed child care providers (who are the State-recognized bargaining unit members because their names are on the CF or RF license).

SPACE Who is eligible for the State & CCPT Childcare Retirement Benefit ? RF/CF providers (the individual whose name is on the license) with an active license as of 12/11/23, AND with an open, active OregonSaves account are eligible for funding. SPACE How do I get my State & CCPT Childcare Retirement Benefit? To receive the State & CCPT Childcare Retirement Benefit, providers must self-enroll in OregonSaves no later than 8:59pm PST on Monday December 11, 2023. Once OregonSaves accounts belonging to eligible providers are verified, funds will be deposited into providers’ accounts in two separate deposits, with the final deposit no later than June 2024. Why did I get an email from OregonSaves asking for more information? space For some enrollees (not just child care providers), OregonSaves may request additional documentation in order to verify your account information. If documentation is needed, you will receive a notice within 30 days requesting action. Please follow the instructions on the notice in order to submit your documentation to be verified. space If you have any questions on submitting additional documentation, please call: space OregonSaves/Vestwell 833-811-7434 space space If my preferred language is not English, how do I get assistance to open my OregonSaves account? space Individuals seeking information in Spanish can visit OregonSaves Spanish The OregonSaves client services team assists in English and Spanish and will have access to translation services for additional languages. space If you need assistance in a language other than English, please contact our client services team Monday-Friday from 7am to 7pm (pacific time). space clientservices@oregonsaves.com or 844-661-1256 save Am I eligible to receive the State & CCPT Childcare Retirement Benefit if I only have an Individual Taxpayer Identification Number (ITIN)? Providers with an ITIN are eligible to receive the State CCPT Childcare Retirement Benefit. An OregonSaves account can be opened with a Social Security Number or an ITIN. After setting up your account, you may be asked to provide supporting documents to verify your information. OregonSaves will reach out to you directly via mail if needed. SPACE What can I do if on Step 2 of opening my OregonSaves account it says “We could not confirm your identity at this time”? If you receive the response “We could not confirm your identity at this time” wait 1-2 business days and try it again. If you continue to receive the same response email aolin@oregonafscme.org who will be submitting a list of names of providers who have had this issue to the OregonSaves management to troubleshoot and ensure you are able to get your account set up. You may receive an email requesting additional information or documentation so during this time watch your inbox and junk and spam folders for an email request. How much is the State CCPT Childcare Retirement Benefit that will be credited to my account worth? The exact amount will be determined after the enrollment period closes on December 11, 2023. $5M will be disbursed evenly among providers who have successfully completed enrollment in OregonSaves. What if I already have an existing OregonSaves retirement account? For any provider that already has an account with OregonSaves due to previous employment or self-enrollment, since you can only have 1 account in OregonSaves due to the account being connected to your SSN/ITIN, you would not need to self-enroll, and simply need to login as you already have an account set up. OregonSaves/Vestwell will receive a list of all providers before 12/11/23 to determine if any RF/CF providers have existing OregonSaves accounts. How do I set up my OregonSaves account?

How do I set up my OregonSaves account without investing my own money?

You must enter the provided promo code in order to bypass the required one-time $500 deposit or recurring $5 monthly deposit normally required to open and OregonSaves account. space What do I do if OregonSaves account with investing my own money? space THIS ANSWER IS UNDER CONSTRUCTION -- PLEASE CHECK BACK OR CALL US Can I add money to my OregonSaves account? How do I do that? Yes. Once your OregonSaves account is created and your information is verified, you can continue to add money to your IRA via bank transfer or check. space What should I enter for ‘Work Status’ in the OregonSaves enrollment process? Please list yourself as “Self-Employed.” What should I enter under ‘What kind of work do you do?’ in the OregonSaves enrollment process? Please list yourself as a “Health Care Professional.” What should I enter under ‘Select a future contribution’ and/or ‘percent to allocate’? These questions are part of the elections/customization each participant has the option to choose for their Roth IRA. Ultimately, with an IRA (or any retirement vehicle), you as the account owner have the choice to select what investment options you want to be invested in within your IRA, and if you want to contribute additional money on a regular basis. OregonSaves (and our Union) can't provide investment advice. OregonSaves does have more information on https://www.oregonsaves.com/savers/investments and on https://www.oregonsaves.com/faqs/saver?tag=investments detailing investment options to help individual investors make those choices. Also, contributing additional money is not required when you use the promo code ORSAVES to self-enroll (although providers will be able to set up additional investments at any time). NOTE: A word of caution from your local union and fellow providers: OregonSaves accounts are Roth IRAs (see below). Be sure that you follow individual IRA account regulations. If you have more than 1 Roth and/or Traditional IRA please visit this IRS webpage to learn more about over-investment penalties, income limits, and annual limits for maximum contributions allowed to all of your IRAs within an investment year (generally between January 1 of that year and tax day of the following year). Again, please consult an investment counselor as noted at the beginning of this FAQ for guidance and investment advice as there is no one right answer to these specific questions. How do I know the personal information I provide will be kept safe and confidential? Individual OregonSaves account information, including but not limited to names, addresses, telephone numbers, personal identification information, amounts contributed and earnings on amounts contributed, is confidential and will be maintained as confidential: · except to the extent necessary to administer the Program in a manner consistent with the Act, the tax laws of Oregon and the Code; or · unless the person who provides the information or is the subject of the information expressly agrees in writing that the information may be disclosed. Can I get my State & CCPT Childcare Retirement Benefit if I already have an existing retirement account? Yes. There are limits to how much you can contribute or invest for your retirement each year. Please note that the annual $6,500 contribution limit ($7,500 if you’re age 50 or older in 2023) applies in total to all IRA accounts that you own.Talk to your tax advisor for more information. Are there tax implications if I receive State CCPT Childcare Retirement Benefit? The funds the state will deposit into your OregonSaves retirement account are considered "Credits" and are taxable income in 2024. These funds (because they are taxed now) will not be taxed when you withdraw them. Providers are responsible for paying federal and state taxes on the Credit deposited into their OregonSaves account. Tax obligations may vary. If you have any questions regarding tax implications, please contact a professional tax advisor. Also be aware of income limits that affect your ability to contribute to a ROTH IRA. If you have contributed to a ROTH IRA in the past, you are likely to be fine but should still consult a financial advisor and/or your tax preparer. While the IRS will release the final numbers in later October 2023, financial advisors from across the country are preliminarily saying that for 2024:

Please be sure to look at your taxable (household) income for 2024 to assess whether (or not) you will exceed the income guidelines and if so, speak to your tax preparer or other financial advisor regarding your ability to accept these funds. IRS Info on Roth IRA Contribution Limits (2023) Watch for 2024 info soon! Breaking down the MAGI term from the IRS Info When can I withdraw funds from my OregonSaves account? Are there penalties for doing so before retirement? (When can I retire?) You can take money out of your Roth IRA at any time. OregonSaves charges no fee or penalty for withdrawing the contributions you make. However, investment earnings are subject to taxation and an additional penalty if taken out before you reach the age 59½ and before you’ve had your Roth IRA for five years. There are exceptions, including the purchase of one’s first home. Please review IRA rules or consult a tax professional. Generally, distributions will be processed within 3 business days of your request. During periods of market volatility and at year-end, distribution requests may take up to 5 business days. If you make a withdrawal from your IRA, you will receive IRS Form 1099-R, which is a tax form that details all of the withdrawals you made throughout the tax year from your account. If I am a current RF/CF provider. If I have a change to: the address of my facility, license renewal, re-opening of my previous license, license type (from RF to CF or CF to RF) am I eligible to receive the State & CCPT Childcare Retirement Benefit? Yes. If you open the required OregonSaves retirement account and you have an active license as of 12/11/23 you are eligible to receive the State & CCPT Childcare Retirement Benefit. Is there a cost to opening an OregonSaves account? Is there a minimum account balance required to keep my account active? Yes, as with any investment or retirement program, there is an ongoing fee which is paid as a percent of the money in your account. The fee for each investment option is approximately 0.50% of its value per year ($0.50 for every $100 saved). There is also an account fee of $4.00 that is assessed each quarter. These fees pay for the administration of the program, and the operating expenses charged by the underlying investment funds in which the program’s portfolios are invested. The asset-based fee is computed daily, and your investment returns are credited to your account minus the fee. You do not need to have a minimum amount in the account to prevent it being closed. Can I recharacterize (change over/roll over) my OregonSaves ROTH IRA into a traditional IRA to avoid taxes? Yes. But the real question is, "Should I recharacterize my ROTH IRA into a traditional IRA?" That answer is most likely, No. In fact, unless you are 59 1/2 years old and had your ROTH IRA funds for at least 5 years, doing so would trigger a 10% penalty tax (not qualifying for an exception). If you do not want to pay taxes on these retirement dollars, the only way to avoid the taxes is to opt out of the funds and to exclude yourself from the retirement fund altogether. What if I still have further questions? CCPT will be hosting info sessions on zoom, the dates and times are listed on the previous page. CCPT is hosting info sessions in Spanish for dates and times email aolin@oregonafscme.org. If you have specific questions relating to your personal finances and/or to receive financial guidance contact your CPA or financial advisor.

Page Last Updated: Oct 19, 2023 (15:24:42)

|

|

-

Paused

2025 Trainings See Below for Full List

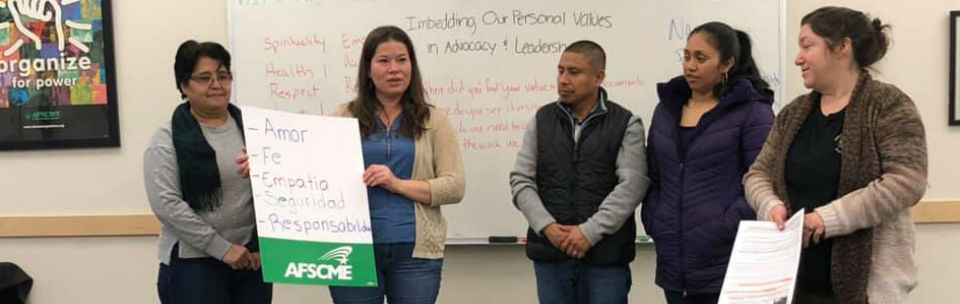

2025 Training Calendar CCPT Local 132 AFSCME You can also check out the dates on our calendar -- not getting notifications and messages from our calendar? Please use the link below the log in box to register for notifications (use a cell phone number and best email to make sure you are getting all the messages).Read More... Download:  2025 Event Registration form.pdf

2025 Event Registration form.pdf

Rally for ERDC 2025

Please use this link to access and your web browser to translate into your preferred language. https://www.surveymonkey.Read More... Member Login

-

- AFSCME Local 132

Copyright © 2025.

All Rights Reserved.

Powered By UnionActive

623772 hits since Jun 06, 2008